The Art Market Is Stuck in 2nd Gear

Clare McAndrew's Art Basel UBS Art Market Report for 2022 is out. Here are our topline takeaways

-

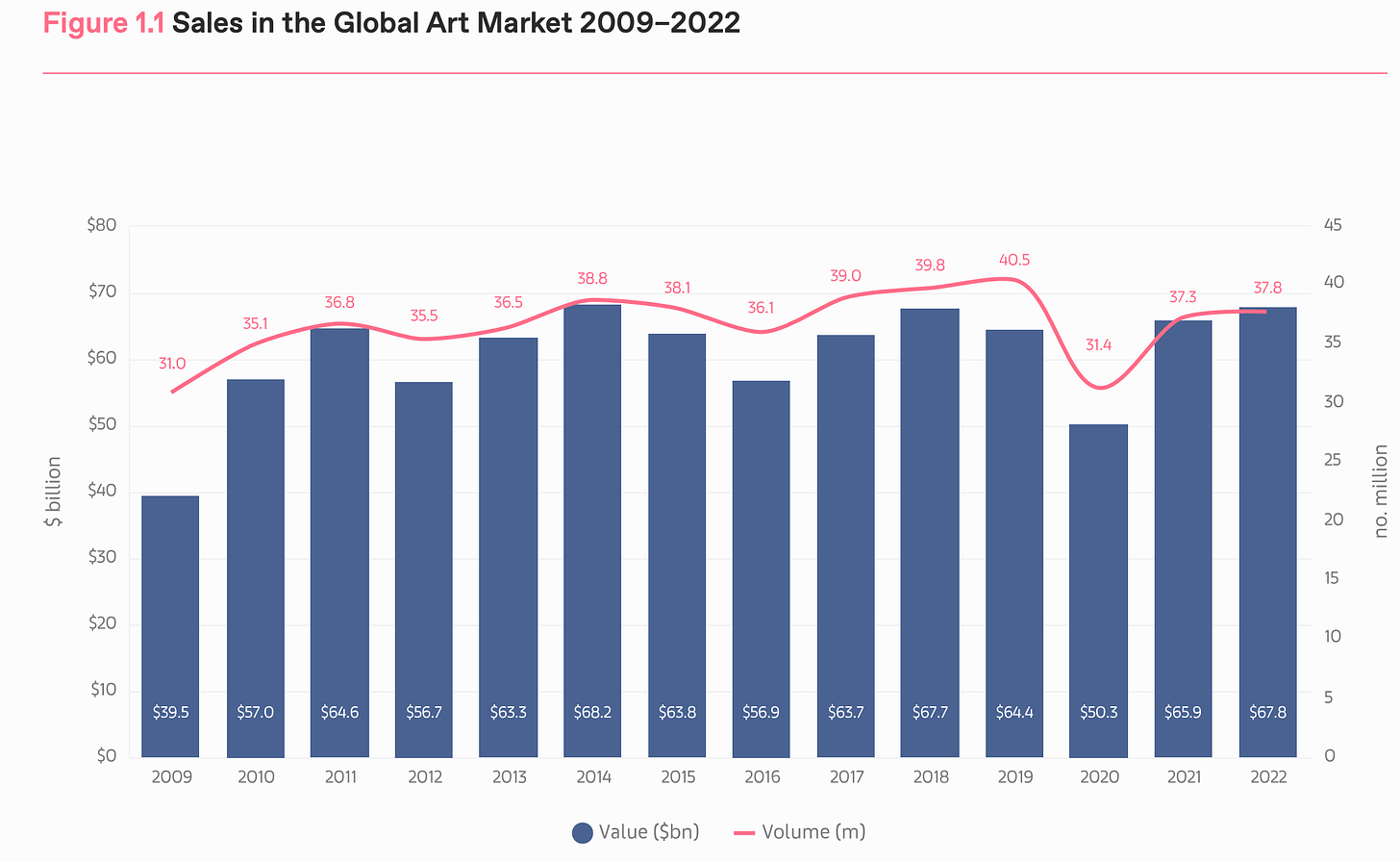

Total art sales $68.7 billion. That’s 3% above 2022.

-

The US represents 45% of global sales by value or $30.2 billion but still below 2019 levels.

-

The UK is second with 18% of sales but remains below its pre-Brexit level.

-

Art sales in China fell 14%.

-

Dealer sales climbed 7% to $37.2 billion.

-

Auction houses accounted for $30.6 billion in sales which is down 2%. The three major auction houses had a record sales volume of $17.7 billion in 2022.

-

61% of dealers who responded to McAndrew’s survey saw a rise in sales; 35% of sales were made at art fairs down from 42% in 2019.

-

Online sales fell as in-person art fairs returned; nevertheless, online sales remained far above the pre-pandemic level.

Overall, the report suggests the art market has done well in 2022 but not as well as might have been expected. One cause for concern is the growth in wealth that hasn’t been matched by art spending. (More on that below.) Althought dealers remain optimistic about their sales in 2023, the market has not accelerate or broadened in ways that the pandemic growth suggested.

Download the report here to read it for yourself. But we went through the report to highlight some of the more interesting buried details.

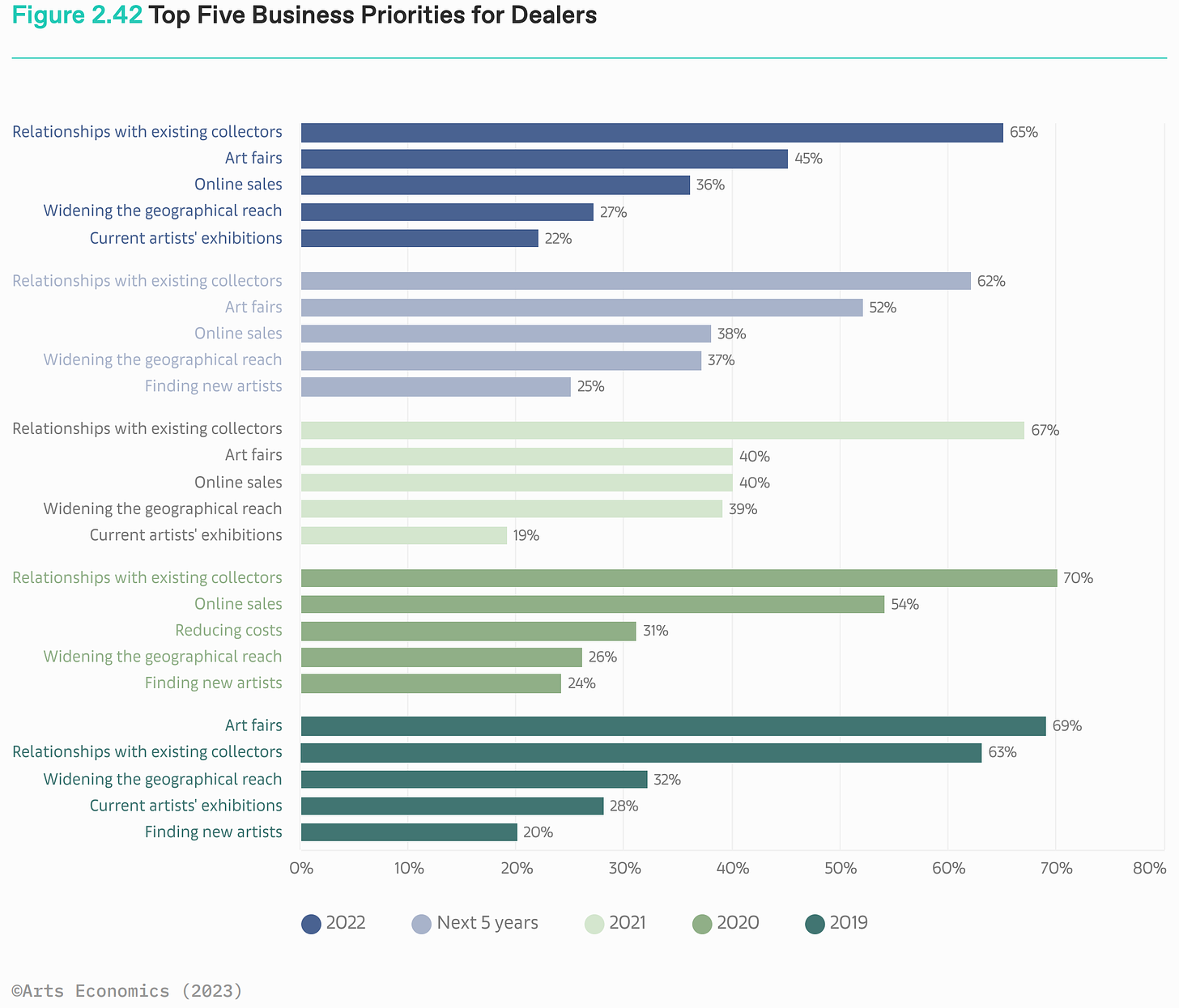

McAndrew’s survey of dealers reveals that an overwhelming majority (84%) see sales remaining the same or improving this year over last year’s strong results. They also have refocused on their relationships with existing collectors in contrast to 2019 when they put art fairs at the top of the list. Fairs are often viewed as place to meet new clients. Here are some of McAndrew’s observations:

-

“At the end of 2022, looking forward to 2023, 45% of dealers expected an improvement in sales, including 10% predicting a significant improvement; 39% thought sales would be stable; and 16% anticipated a decline (against only 11% in 2021). The smallest dealers with turnover of less than $250,000 were the most optimistic about sales heading into 2023, with just over half (52%) expecting an increase.”

McAndrew points out that collectors are looking for value, not bargains. They don’t mind spending more:

-

“The surveys revealed that while their share of spending at prices under $50,000 had more than halved between 2019 and 2022, the proportion in the $1 million-plus range increased from 18% to 31%, and at the $10 million-plus level had doubled (to 12%). HNW collectors remained optimistic about the global art market in 2023, with a majority of 77% positive about its outlook, and only 6% pessimistic. The surveys also indicated strong spending plans for this year, with a majority (55%) planning to buy art in 2023, including 65% in the US.”

Clare McAndrew estimates total art market sales at $67.8bn which is $400m below the $68.2bn she estimated for 2014. Those results came from the sales of 37.8 million works privately and at auction. That number of lots was exceeded in five previous years.

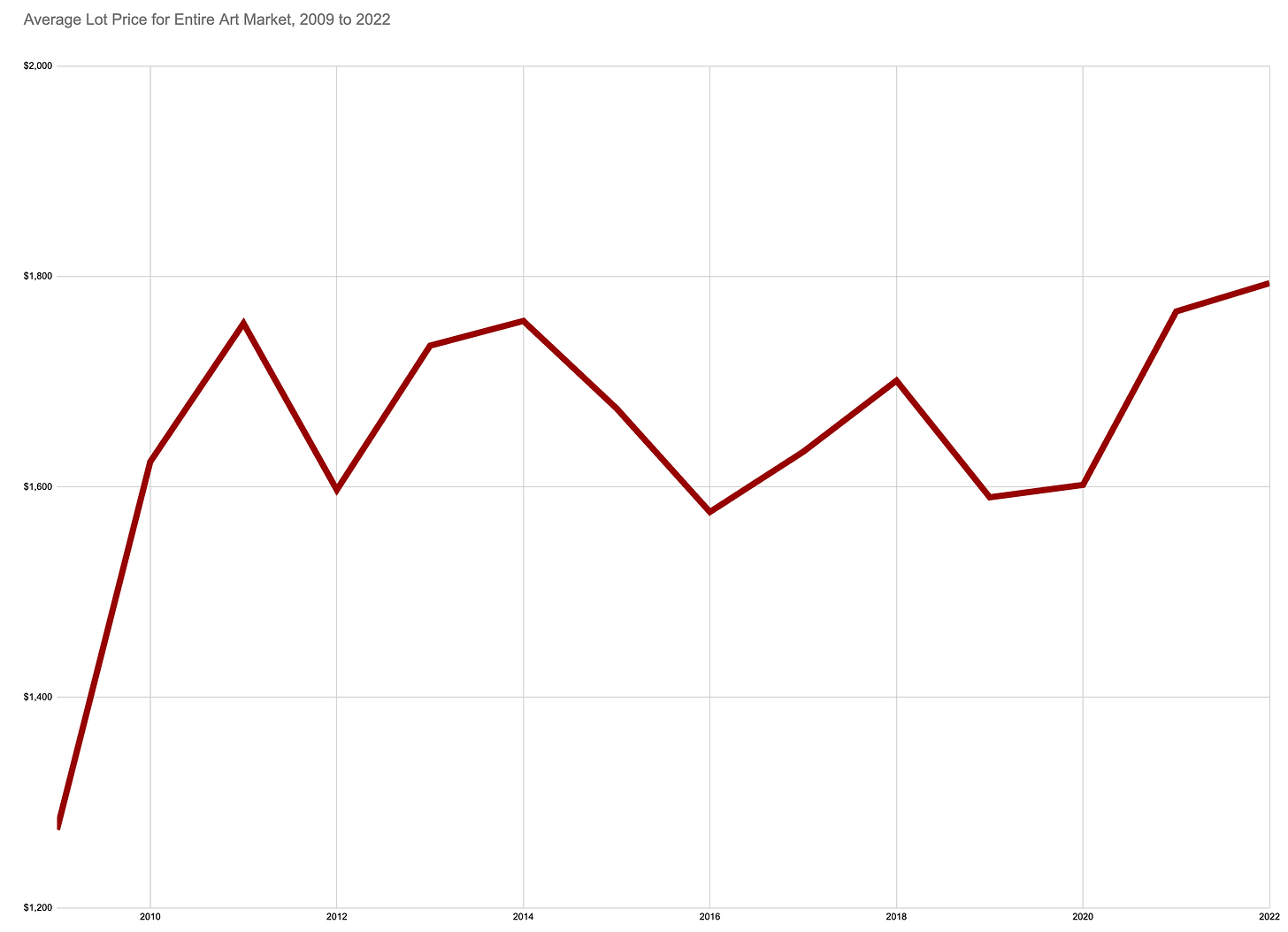

To illustrate this a little better, we have calculated the average price of a lot for the years 2009-2022 based upon McAndrew’s data. That chart is below. It shows the average lot price peaked in the last two years. Why is that important? Because it shows that market is growing by increasing in value (which may reflect inflation) rather than by growing in size (more sales to more collectors.)

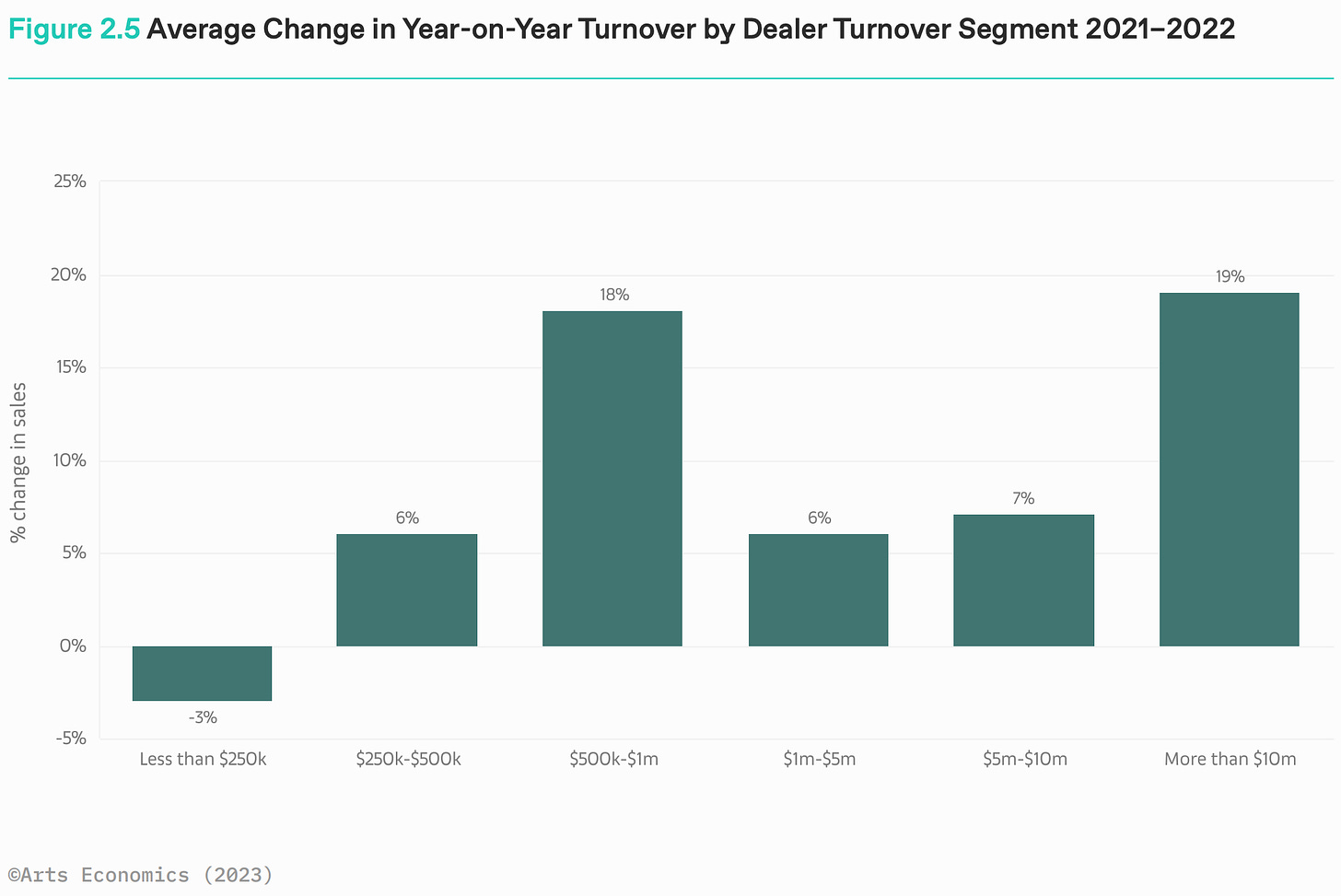

McAndrew observes that there has been a marked shift in spending in both the private dealer and auction markets. First she points out that large galleries saw the biggest jump in sales:

-

“Surveys of the dealer sector in 2022 showed that those with the highest turnovers of over $10 million saw some of the largest increases in average sales values, at 19%. The smallest businesses struggled with price-conscious and cautious buyers, rocketing costs, and more stagnant sales, with a decline of 3% for those with turnover of less than $250,000. This segment also had the smallest rise in sales from 2020 to 2021 (at 6%, versus 27% in the $10 million-plus segment).”

This was mirrored by auction results that skewed toward works above $1 million and above $10 million:

-

“In the fine art auction market, works selling for more than $1 million accounted for 60% of the value of sales in just 1% of lots sold, with 32% from works sold for over $10 million. While virtually all other price segments experienced a drop in value year-on-year in 2022, sales of works priced over $10 million increased by 12% despite a smaller number of lots sold, revealing an increasingly thin but strongly performing high end.”

-

“In the period from 2009 to 2022, the $10 million-plus segment grew in value by close to 700% while the lower end (works priced at less than $50,000) saw a much more moderate increase of 10%. If these figures were adjusted for inflation, while the highest end still grew to more than five times its size over the period, sales below $50,000 declined in value.”

At auction, sales are declining in volume in every other category but Contemporary art. McAndrew’s analysis of auction categories shows Modern, Impressionist and Old Masters declining lot volume. There was a rise in 2021 and 2022 in Impressionist sales value. But Post-War and Contemporary art had the most auction value and the highest number of lots, too. Within the report you will see some interesting data on where the greatest value lies in the art market. Hint: it involves time and selection bias. Nevertheless, art made in the last 75 years dominates the art market today.

McAndrew points out the rapid rise in the number of billionaires and the wealth they hold was not matched by a rise in art spending. Or, if it was, that spending concentrated into more expensive works rather than more works:

-

“[B]illionaire wealth has more than doubled in 10 years, and it has increased by more than one third since 2019, just before the onset of the pandemic. Along with the adaptions made by the market, the expansion in wealth for the world’s richest individuals has undoubtedly helped the art market weather the COVID-19 crisis better than it otherwise would have and to recover more rapidly. The extent to which these billionaires have focused their buying on the thin segment at the top of the market may, however, have increased inequalities in how businesses in the art trade have fared.”