The Market for Emerging Artists Defies the Odds

The New York sales show that 21st Century art at lower price points is buoying a market that everyone thought would fade.

Higher Total Sales in a Slower Market

The art market in New York showed surprising strength last week. In London, the week before, sale volumes and average prices were off by 30%; in New York, on a sale-for-sale basis, sale totals were only off by 4.5% but the average prices were down nearly 28%. On the one hand, these numbers suggest a serious market retreat. On the other hand, there is additional evidence that might point to London experiencing a secular shift as a sales center that accounts for the 30% drop.

In these like-for-like sales, the three auction houses offered and sold in New York more lots in 2023 than they did in 2022. That kept sale totals close to the previous year even as the average prices dropped. Another way to say that is that demand from art buyers did not wane. It merely shifted to lower value works. Buyers bought more of those lower value works to uphold the year-over-year sale totals.

This is an important market signal. We’ve discussed the presumption that a economic recession would prompt a “flight to quality.” Yet in these results we’re seeing something slightly different. One sales cycle, especially one that focuses on lower value works, does not determine a trend. But it is an interesting market signal.

The New York sales cycle had two additional single-owner sales that boosted the overall total for the week. Both sales were held Christie’s; both featured a mix of art work and design objects. Adam Lindemann was the named collector; another figure from the Pacific Islands was the other.

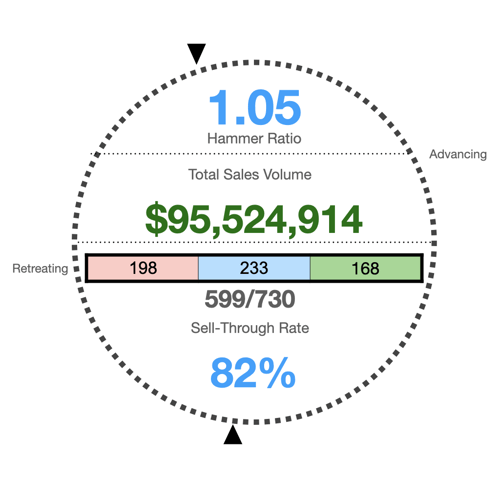

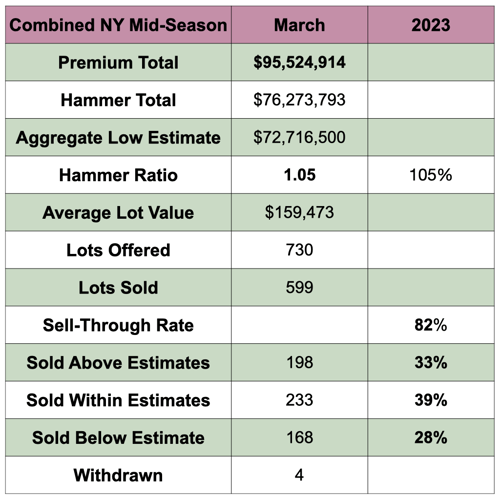

The additional $34 million in art works (not counting the design objects or photographs sold) helped increase the market activity in New York in 2023 over 2022. Comparing 2023 to 2022, the total money spent on art was up 31.6% with the number of sold lots rising 28%. When the two single-owner sales are added, the average prices were essentially a wash. In 2022, the sales had an average price of $161,778 but this year, with the single-owner sales, the average price reached $159,473.

A Tepid Market with Sufficient Demand

The 82% sell-through rate also reflects a retreat from 85% last year. There is a softening of competition for works.

Of the lots sold, the proportion of lots sold above, within and below the estimates is evenly distributed with a slight bias toward the estimate range. A third of works sold went for prices above the estimate range; 39% sold within the estimates; and 28% were sacrificed at prices below the low estimate.

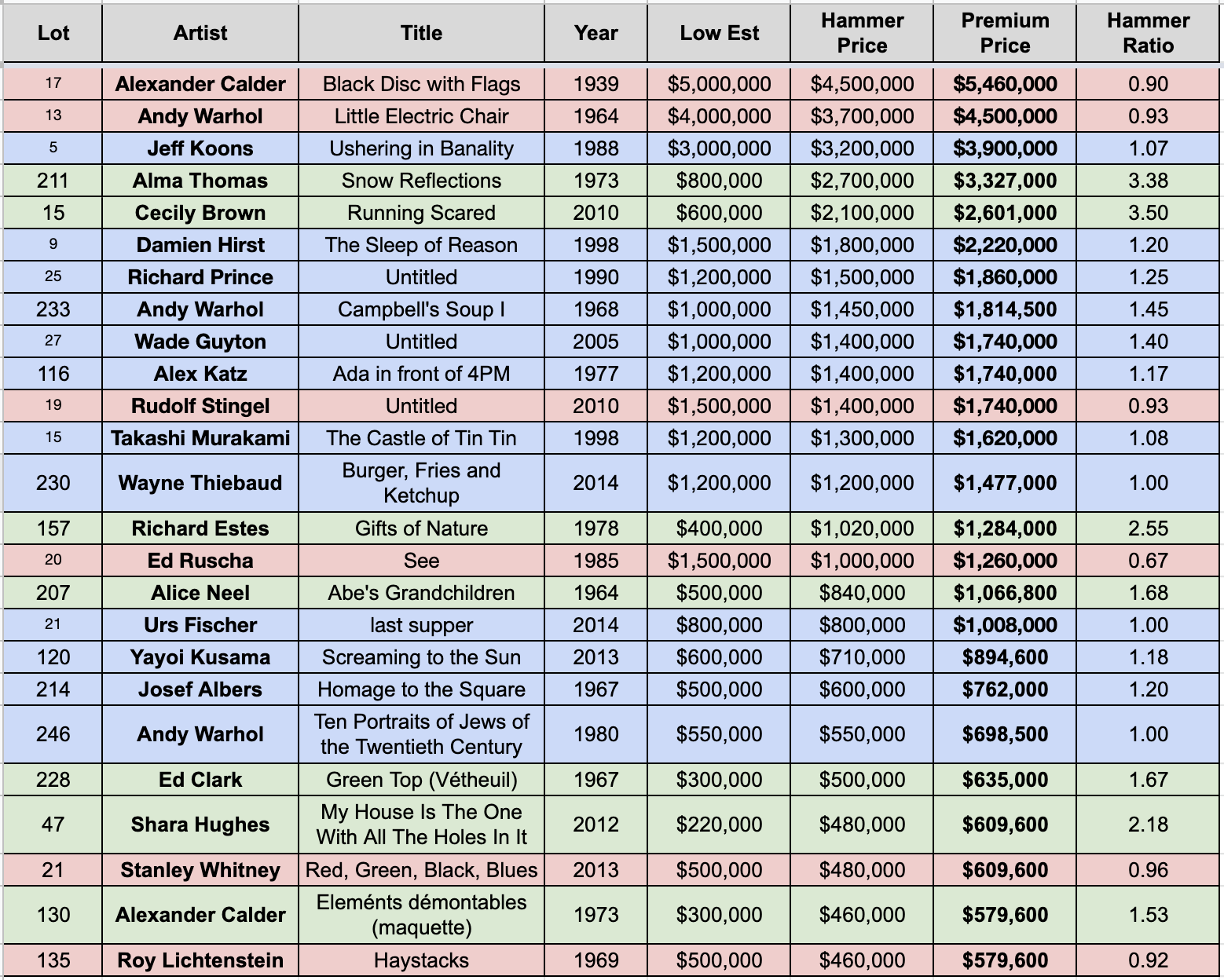

Adam LIndemann Lands on Top

Without Adam Lindemann’s single-owner sale, the top lots would have been Alma Thomas’s Snow Reflections what was bid to more than three times the estimates and Cecily Brown’s Running Scared which made three and a half times the estimate. Those sales were driven by the demand for each artist’s work but also reflect the strong interest in work by women. A recent report used the art market to try to show the poor progress made in representation but it focused on the entire art market. Women artists remain under-represented in the Contemporary and 21st Century art markets but make up a greater portion of the market share than in the broader art market.

Without Adam Lindemann’s single-owner sale, the top lots would have been Alma Thomas’s Snow Reflections what was bid to more than three times the estimates and Cecily Brown’s Running Scared which made three and a half times the estimate. Those sales were driven by the demand for each artist’s work but also reflect the strong interest in work by women. A recent report used the art market to try to show the poor progress made in representation but it focused on the entire art market. Women artists remain under-represented in the Contemporary and 21st Century art markets but make up a greater portion of the market share than in the broader art market.The top 50 artists in the New York sales cycle contain the work of 14 female artists. Given the long lead time required to accumulate value in the art market, women will continue to make the most progress in 21st Century art sales that are biased toward the most recent work.

Alice Neel’s Abe’s Grandchildren made a strong sale at Sotheby’s to add another woman to the list of top prices. Shara Hughes’s continuing market strength has defied expectations what her market would need a hiatus to rebuild demand.

Adam Lindemann’s own works were sold reasonably well against estimates but the five top works—with Alma Thomas and Cecily Brown sandwiched in between—all sold for prices at the low end of the estimates or below the low estimate. These five lots also happen to be easily tracked against previous auction sales. The only work among the five that was sold for a price greater than the acquisition price was the Hirst medicine cabinet which was originally bought in 2004.

The other noteworthy sale among the top 25 lots was Richard Estes’s Gifts of Nature from 1978. More than six-and-a-half feet wide, the painting made $1.28 million which is a new record for the artist by a good 50% over the last record price set in 2020. Three of Estes’s top five prices were set in the last six months—all at Christie’s.

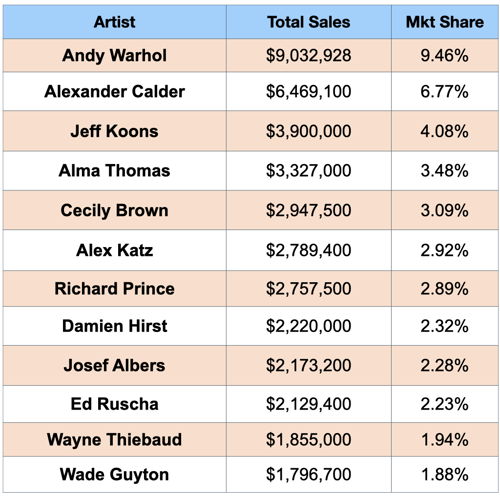

Andy Warhol’s market share in these sales was boosted by Lindemann’s Little Electric Chair which accounted for half of the total for the artist. The additional boost of a new top price for a set of Warhol’s Campbell’s Soup I from 1968. At $1.8 million, the complete set of prints sold for nearly 50% more than a set auctioned at the end of October for $1.26 million. That’s a big rise for a work made in an edition of 250.

Andy Warhol’s market share in these sales was boosted by Lindemann’s Little Electric Chair which accounted for half of the total for the artist. The additional boost of a new top price for a set of Warhol’s Campbell’s Soup I from 1968. At $1.8 million, the complete set of prints sold for nearly 50% more than a set auctioned at the end of October for $1.26 million. That’s a big rise for a work made in an edition of 250. Alexander Calder usually provides these sales with ample material. This season, there were only five lots from the artist and one, a mobile sold by Lindemann, made up the vast majority of the total. Jeff Koons made the market share list with the one work from the Banality series sold by Lindemann. Alma Thomas’s one runaway sale was enough to account for nearly 4% of the sale totals. At $3.3m with premium it is now Thomas’s highest priced auction sale. Cecily Brown had only two works on offer this time. Both sold for more than three times their estimates. Alex Katz’s work seems to be having a strong doppler effect from the Guggenheim retrospective. Seven works sold at a wide range of price points mostly within estimates but with one work making 2.5 times the low estimate for a 1985 work. Richard Prince also saw the benefits of the Lindemann sale to make the market share list with three works, two from Lindemann. Damien Hirst, too. Four Josef Albers lots, all selling within the estimates or near the low estimates, made solid prices based on the recent strong sales for the artist. Ed Ruscha actually had a tough auction cycle with 40% of the lots offered getting bought in. The bulk of the value came from the cover lot of the Pacific Islander’s single-owner sale. That work sold below the low estimate but it was still enough to account for 2.23% of the spending. Wayne Thiebaud had a similar trajectory: three lots offered, two sold but still enough from a single lot to make nearly 2% of the money spent. Wade Guyton’s work from the Lindemann sale also vaulted it into the top 12 names by market share.

The Affordable Art Fair

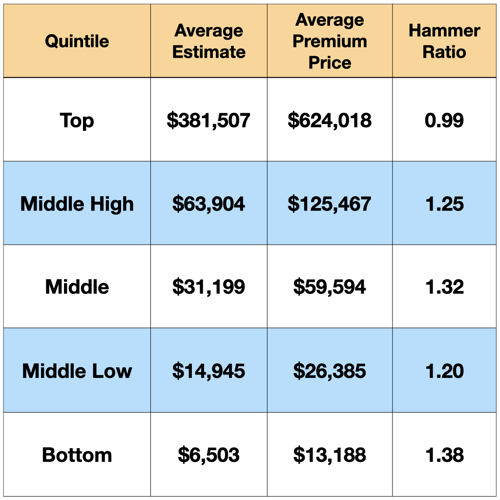

The weakness at the top of the market is evident in the bidding quintiles. We divided the 730 lots offered into quintiles. The top 146 works had an average estimate of over $380,000 but a hammer ratio of only .99. Those works sold for an average price of $624,018. (**Average premium prices are much higher than the hammer ratio due to the survivorship bias. That means we average the estimates for the quintile but only use the sold lots from that group to calculate the average premium price.) The second quintile had an average estimate of just under $65,000. The bidding was a healthy 1.25 hammer ratio for an average selling price of $125,000. In real world terms, that means if you’re bidding on a lot that sells around $125,000 you’re going to face some competition but not too much. The middle quintile was stronger than the quintile. There a 1.32 hammer ratio was seen for works estimated around $30,000 and selling for an average of $60,000. The middle low quintile was slightly weaker than both of the above with a 1.20 hammer ratio for works estimated around $15,000 and selling for an average of $26,000. But the strongest bidding was seen in the bottom quintile where lots with an average estimate of $6500 got bid to a 1.38 hammer ratio. Those works sold for an average of $13,000.

The weakness at the top of the market is evident in the bidding quintiles. We divided the 730 lots offered into quintiles. The top 146 works had an average estimate of over $380,000 but a hammer ratio of only .99. Those works sold for an average price of $624,018. (**Average premium prices are much higher than the hammer ratio due to the survivorship bias. That means we average the estimates for the quintile but only use the sold lots from that group to calculate the average premium price.) The second quintile had an average estimate of just under $65,000. The bidding was a healthy 1.25 hammer ratio for an average selling price of $125,000. In real world terms, that means if you’re bidding on a lot that sells around $125,000 you’re going to face some competition but not too much. The middle quintile was stronger than the quintile. There a 1.32 hammer ratio was seen for works estimated around $30,000 and selling for an average of $60,000. The middle low quintile was slightly weaker than both of the above with a 1.20 hammer ratio for works estimated around $15,000 and selling for an average of $26,000. But the strongest bidding was seen in the bottom quintile where lots with an average estimate of $6500 got bid to a 1.38 hammer ratio. Those works sold for an average of $13,000. Hammered Hard

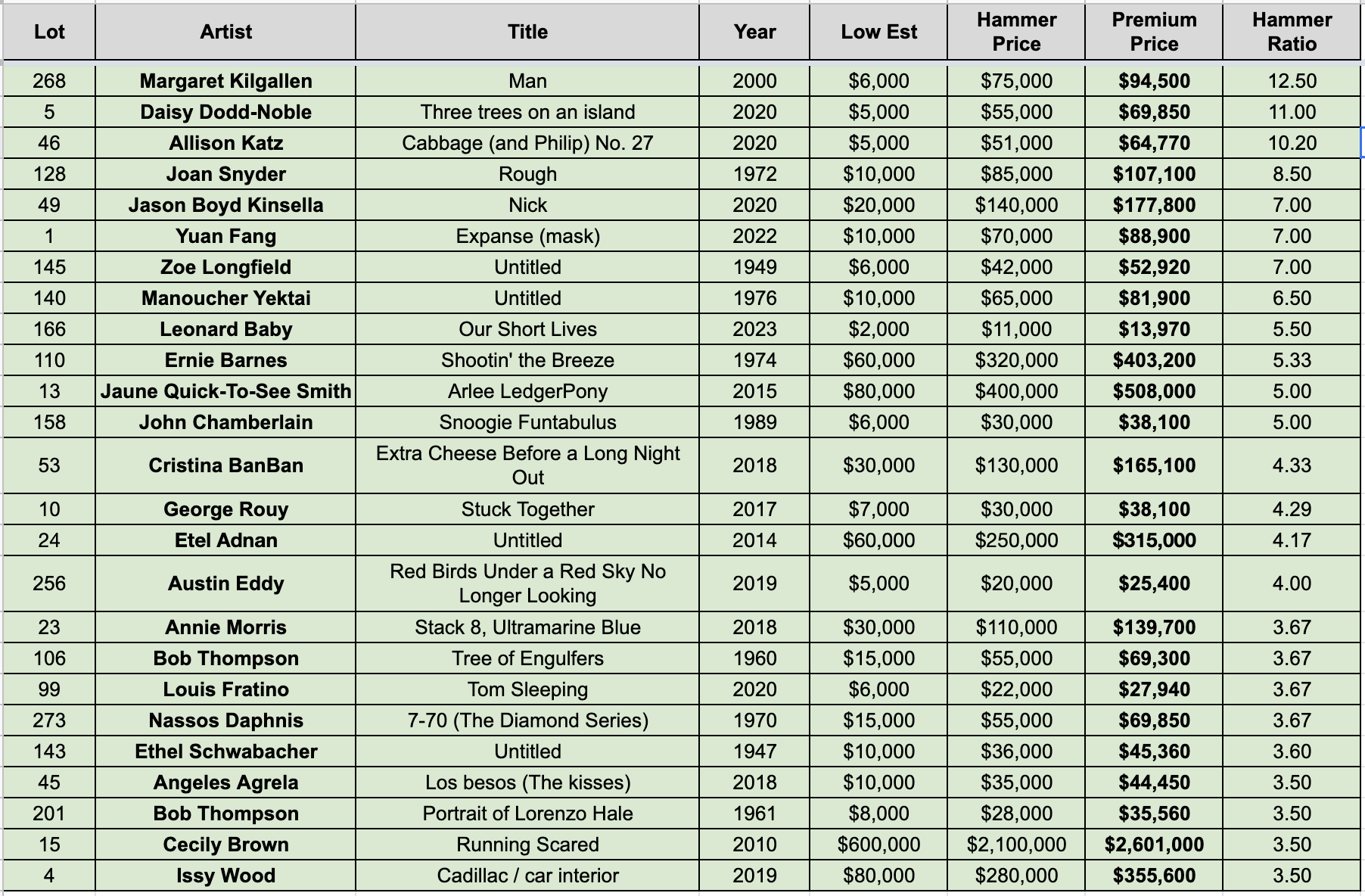

The list of the works with the most dynamic bidding was a potpourri of artists, especially female artists who made up more than half of the list. At a range of price points, buyers were chasing after a range of historical artists like Bob Thompson and Ethel Schwabacher, as well as Contemporary painters like Daisy Dodd-Noble and Jason Boyd Kinsella.

The list of the works with the most dynamic bidding was a potpourri of artists, especially female artists who made up more than half of the list. At a range of price points, buyers were chasing after a range of historical artists like Bob Thompson and Ethel Schwabacher, as well as Contemporary painters like Daisy Dodd-Noble and Jason Boyd Kinsella.